Discrete Damages and Cost Variance Analysis Method for Quantifying Damages in Construction Claims

This article discusses the seven steps involved in a discrete damages and cost variance analysis method. In addition, it addresses the development of cost analysis databases, control budget calculations, actual cost calculations, a cost variance calculation, and allocation of cost variances.

1. INTRODUCTION

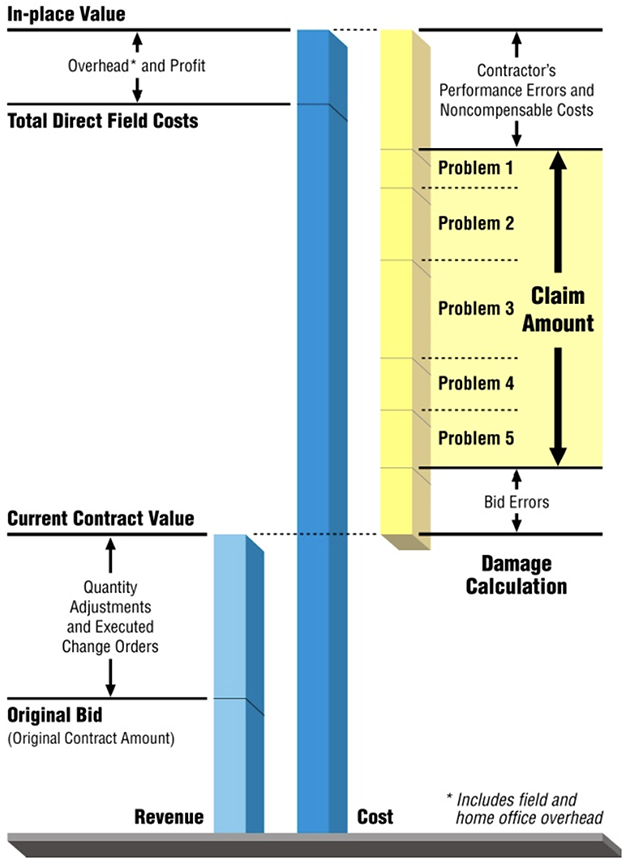

The “discrete damages/cost variance analysis method” for quantifying construction claim damages involves the specific distribution of all costs incurred on the project rather than quantifying only certain parts of the cost or damage analysis as may be used in the other methods. The credibility of this method is established by separating the cost growth that results from bid error, noncompensable, and compensable cost problems, as established by first using the modified total cost method, and then identifying individual compensable problems with specific costs tied to each problem. In addition, the cost growth for each claim problem is applied to each relevant cost account to demonstrate that the “sum of the parts” of each claim does not exceed the whole cost overrun for each cost account. The discrete damages/cost variance analysis method is illustrated by Figure 1.

Figure 1

Discrete Damages/Cost Variance Analysis Method

The discrete damages/cost variance analysis method appropriates all costs taken from the claimant’s cost records into cost variance analysis categories, which set forth the claimed costs separate from the other noncompensable causes of cost overruns. These construction cost variance analysis categories include the original bid, any bid errors, approved changes, pending changes, specific compensable problems (claims), and noncompensable (or nonrequested) costs. Because the claimant is in each case associating a particular item of damage for each compensable problem, the cause/effect relationship is established as the numbers are calculated. Accordingly, the claimed amount is both easy to verify and difficult to refute. Most contractors maintain cost records that have some degree of subdivided cost account detail. Therefore, it is more credible to demonstrate variances at the greatest level of detail possible using the available cost records.

However, this method may be difficult to apply in a case where there are several interrelated cause-and-effect relationships, such as a project impacted by numerous change orders as well as contractor-caused problems. Using this method, the damages that may be caused by the discrete damages category, cumulative impact of changes, would be calculated directly using industry studies, or the measured mile method, or indirectly by claiming some portion of the remaining cost overrun in each cost account. Depending on the method used for calculating productivity loss, the claim is often calculated on a cost account basis or based on all remaining labor overruns if those overruns can be tied to the impact of the issues being claimed.

The advantages of this discrete damages/cost variance analysis method are:

- Because all components of the cost records are evaluated and distributed into the claim matrix, the total value of the requested funds can be fully explained and justified.

- The link between entitlement and the amount of damages is developed at the lowest level of detail of the cost records, thus providing significant credibility to the burden of proof.

- Isolation of the damages of cost components and individual claim problems identifies the hard areas of claim while also identifying the soft spots to be negotiated, if necessary.

2. SEVEN STEP PROCESS

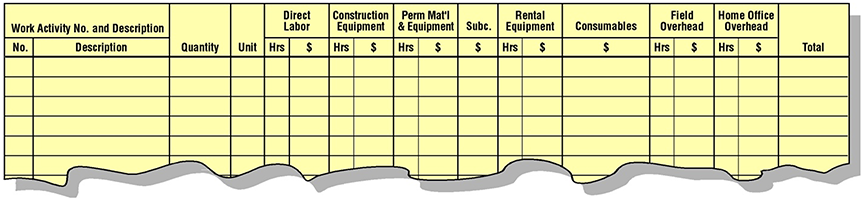

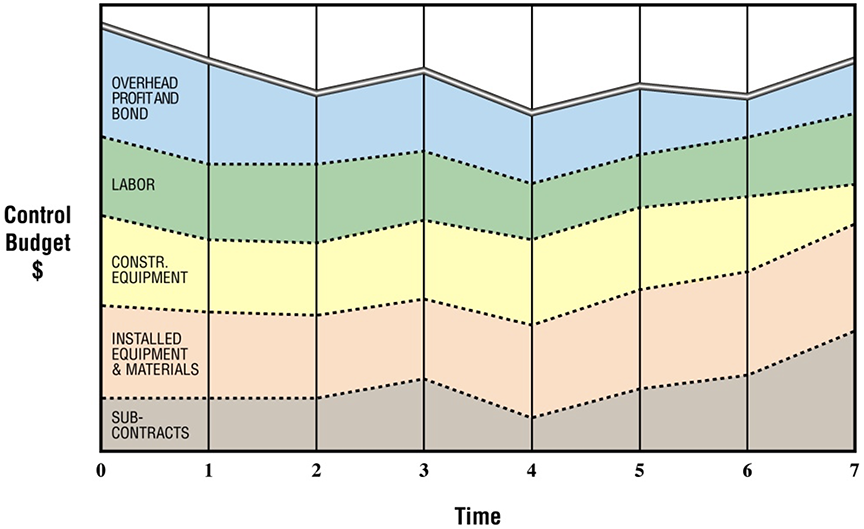

The discrete damages/cost variance analysis method involves seven steps. By analysis of the detailed cost records, each project work activity is first divided into the basic cost elements (cost accounts) of direct labor, labor burdens, construction equipment ownership and operating expense, rental equipment, subcontracts, permanent materials and equipment, consumable materials and supplies, field overhead, home office overhead, and profit. A typical cost account structure is shown by Figure 2. The bid cost (budget) and the actual cost for each cost element of each project activity are identified.1

Figure 2

Typical Cost Account Structure

Secondly, the detailed project as-planned and as-built schedules are analyzed to identify the time frame of specific delays, disruptions, changes, labor strikes, suspensions, adverse weather conditions, deliveries of critical equipment and material, acceleration, etc. The time frame for each problem isolates when each problem and cost occurred, which can then be traced back to the contractor’s job cost reports and other man-hour records.

The third step involves evaluation of the contractor’s bid estimate to determine if it underestimated any cost elements of any activity. Knowledge of industry standards, efficient construction techniques, man-hour productivities, and cost estimating are essential to properly evaluate the contractor’s bid. In addition to the evaluation of bid errors, all approved and pending changes to the contract price are applied to derive an adjusted bid value for each work activity.

As a fourth step, each activity and its cost elements are evaluated for noncompensable cost items. These may include costs incurred because of labor strikes, idle time due to bad weather, equipment down-time caused by the contractor’s improper operation or maintenance, inefficient management of the contractor’s labor or of subcontractors, or other cost items that are clearly not the owner’s responsibility. The actual cost for each activity is reduced by such noncompensable costs to derive an adjusted value.

As a fifth step, each activity is assessed by time frame for the impact and cost overrun caused by each specific claim problem. Damages such as additional labor, equipment or material costs, premium time, second shift costs, reduced productivity, extended overhead, financing costs, and labor or material escalation are identified and assigned to the appropriate claim problem to complete the distribution of all project costs. Cost overruns outside the time frame in which the problem or its effect occurred are excluded from the compensable cost distribution and, therefore, are noncompensable.

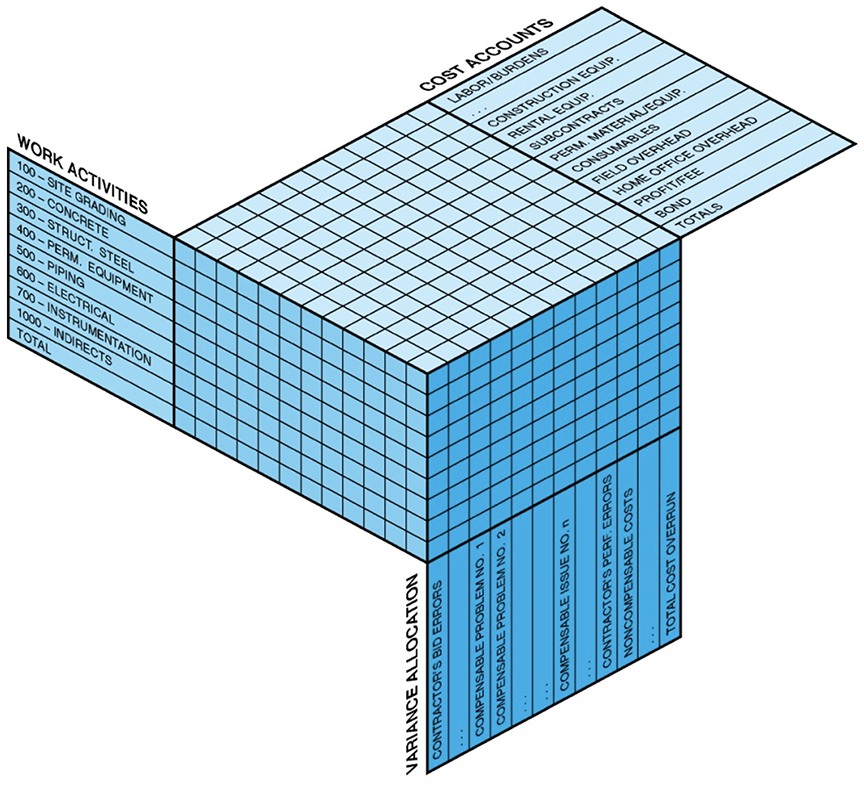

In the sixth step of cost analysis for construction projects, the cost/damage analysis matrix of the damage analysis components, project work activities, and cost accounts are totaled to determine the specific dollar amount of each requested claim (compensable problem). The actual cost for each project work activity by row is first distributed into one or more of the appropriate cost accounts. The actual cost in each cost account of each activity is then distributed into the appropriate damage analysis component category. The cost/damage analysis matrix is illustrated in three dimensions by Figure 3.2

Figure 3

Three-Dimensional Damage Matrix

As a final, seventh step, the claimant must clearly communicate the basis of the distribution of costs into the claim categories and support each element of the requested compensable damages with a cause-and-effect explanation to support the entitlement for cost recovery.

3. DEVELOPMENT OF CONSTRUCTION COST ANALYSIS DATABASES

The structure of the methodology first requires the establishment of two separate data bases, a control budget data base, and an actual cost data base, which are linked by work activity and cost element definition. A third data base called cost variance/allocation is developed from the first two.

3.1 CONTROL BUDGET CALCULATIONS

The control budget is a restatement of the original bid estimate in a form that facilitates comparisons between budget and actual costs. The control budget is normally prepared after bid opening and before construction starts.

The control budget is not the contractor’s bid. The bid proposal is the price sheet used in the contract as the basis of payment for work performed. The contractor prepares an estimate of costs, overheads, and anticipated profit (the total of which becomes the bottom line of its bid), but the makeup of individual cost elements becomes hidden when assigning values (prices) to each bid item. Bid unbalancing is common. In addition, payment is usually based on units of work completed and not for interim steps along the way. An example of the latter is payment for concrete—paid for by the cubic yard, in place. No separate payment is usually made for forming, finishing, etc. For this reason, the control budget (which shows separate estimated costs of forming, finishing, and placement of concrete), and not the bid schedule, is to be used as the basis for comparison for calculations of damages using the discrete damages/cost variance analysis approach.

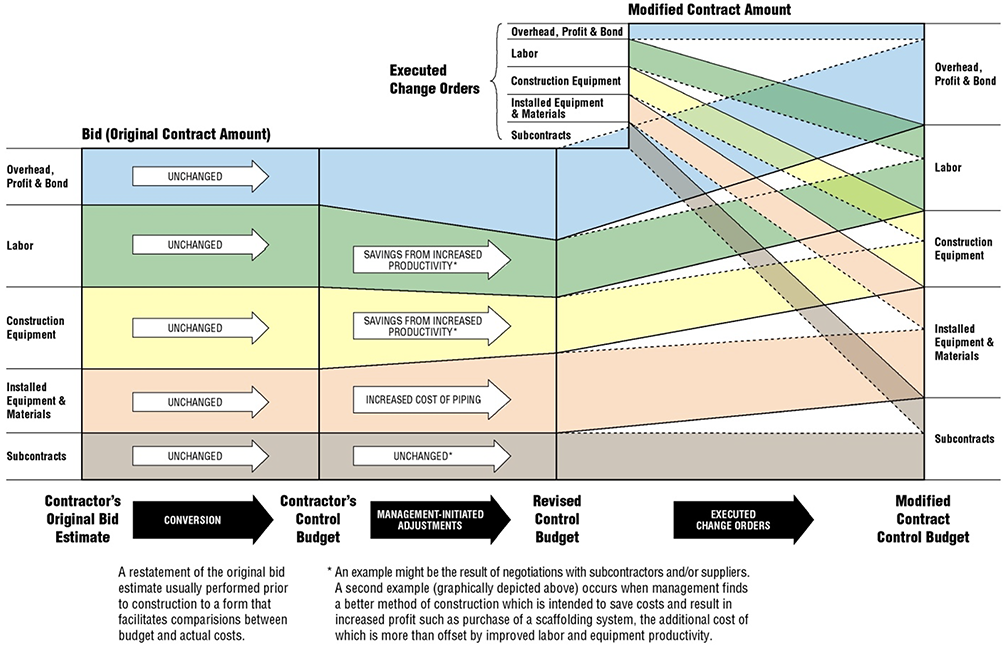

Control budgets usually vary over time, as illustrated by Figure 4.

Figure 4

Control Budget Revisions with Time

Various events cause this variance to happen; the most common being pay quantity variations, change orders, contractor-initiated improvements to means and methods, and subcontractor and supplier negotiations, as shown by Figure 5. In constructing a control budget data base, the time dimensions must be included. On one case, a contractor submitted a modified total cost claim of $4 million. The owner’s outside auditor validated the loss at $4 million. When time-related cost reports became available through discovery, it was found that the contractor had lost $3 million prior to the first event stated to have caused the delay claim. The result was that the contractor’s “window of opportunity” for recovery of its losses suddenly became only $1 million.

Figure 5

Sample Evolution of Control Budget

The contractor’s management-initiated adjustments need to be well addressed and well structured in the damages presentation. Examples of management-initiated adjustments include the result of the contractor’s negotiations with subcontractors and/or suppliers. A somewhat common occurrence might be a subcontractor dropping its price by $50,000 because the contractor furnished scaffolding service to the subcontractor. The contractor’s additional cost of providing this service may be $15,000, which would result in an increase to the contractor’s profit of $35,000 (which the contractor then owns). Other examples of management-initiated adjustments involve post-bid improvements in means and methods.

The structure of the control budget database, including original, revised, and modified contract elements, must be time-variance oriented and trackable for categories of events. Typically, a contractor estimates the cost of the project on a two-dimensional spreadsheet showing work activities on one axis and cost elements on the other. To provide for the complete comparison to actual costs, a third dimension – time – needs to be considered. Each event that changes the control budget is expressed as an additional spread sheet containing the cost revisions to the preview control budget. In addition to the above considerations, which only mention costs, it is usually advantageous to provide for quantities of work, labor hours, and equipment types and hours.

In summary, a properly constructed control budget data base for use as the basis of comparison to actual costs as part of a discrete damages/cost variance analysis calculation method must be fully integrated and time sensitive.3

3.2 ACTUAL COST CALCULATIONS

Actual costs are recorded and reported as construction progresses. Labor costs are based on periodic payrolls. Equipment use hours are developed from operators’ time cards and validated from recorded readings on hour meters. Construction equipment charges are based on hours of operation. Material costs are captured from invoices and paycheck stubs as are subcontractor costs.

The key to organizing the cost data for comparison to the control budget is proper and timely coding and posting to an account structure defined by the control budget. Correlation and integration of cost accounts to an appropriate activity level definition in the project schedule also facilitates the cause-effect connection of the problem and the cost overrun. If this correlation is performed well, subsequent cost and damage analysis work becomes a simple chore. If it is not done well, the effort is large and the resulting cost becomes one that is not normally recoverable in a claim.

In well-organized cost tracking, the cost of additional work directed by the owner is easily determined. However, the discrete damages/cost variance analysis method (as well as the modified total cost method) is most applicable when many changes to the work occur simultaneously and result in changes to the unchanged work (productivity impact and resultant delay to completion).

Sometimes cost accounting adjustments are required; for example, when costs are miscoded and posted to an incorrect period of time. A case of miscoding is illustrated by a contractor’s claim for $200,000 for owner-caused productivity impact on installing large bore pipe. The contractor’s original bid estimate and control budget for the work was $500,000. The actual cost, as posted, was $700,000. The contractor’s bid estimate and control budget for placing the pipe hangers was $100,000. The actual cost report showed no cost for the pipe hangers. Review of the project history through document analysis and interviews revealed that the foreman responsible for the pipe installation was also responsible for the pipe hangers. All of the pipe hangers had, in fact, been placed. The foreman had not separated the pipe hangers effort but had recorded all efforts to the piping installation task. The result was the contractor’s claim was reduced to $100,000 ($200,000 piping installation overrun less $100,000 adjustment for the pipe hangers).

Cost posting to an incorrect period is all too common for materials, outside equipment rental, and subcontractors. Usually what happens is that the cost is posted during the period that the invoice is paid, which is a month or more after the work was performed or the material incorporated in the work. Appropriate cost accounting adjustments must be made to the actual cost database prior to the final comparison forming the basis of damage recovery using the discrete damages/cost variance analysis method.

In addition to the above considerations, it is usually desirable to make a cost comparison on both actual quantities of work and earned value.

In summary, a properly constructed actual cost database must also be fully integrated and time sensitive.

3.3 COST VARIANCE CALCULATIONS

Cost variance calculations are simply the mathematical differences between budget elements and actual costs, preferably computed for increments of time and in total. By considering all project costs in the variance analysis, the analyst is afforded the opportunity to identify anomalies, such as the pipe hangers issue discussed earlier, and make appropriate cost accounting adjustments. Proper adjustments make the cost variance analysis more credible.

The use of a cost variance analysis is a fundamental component of the contractor’s damages calculations on a complex engineering, procurement, and construction project where the contractor is attempting to recover its increased costs for numerous problems affecting multiple disciplines of work. A contractor’s failure to utilize this approach could severely limit the credibility of its claim because:

- The absence of support for the contractor’s actual costs at the detailed cost account level in its cost reporting system may question whether the contractor actually incurred cost overruns in the areas of work that it alleged it was damaged;

- The absence of its bid estimate details, including the assumption it made in preparing its bid, may question whether the contractor is attempting to recover for its bid error;

- By addressing the cost variance at the detailed cost account level, and demonstrating that the sum of all of cost increases for each cost account, including those cost increases for which it seeks additional compensation, do not equate to more than the costs that the contractor incurred for each cost account; and

- The contractor has addressed costs that result from its performance problems in addition to costs for which it is seeking additional compensation.

A cost variance analysis must often be supplemented by a quantity4 variance analysis to ensure that:

- Increases in man-hours and related costs are not the result of quantity growth due to the contractor’s bid error;

- The contractor can separate quantities that are included in approved and pending change orders, and not comingle the man-hours required to install those quantities with man-hours due to productivity loss;

- The unit man-hours to design or install different types of engineering or construction quantities can be separately applied during the variance analysis calculations;

- The contractor has considered quantity overages due to over-procurement and waste;

- Material and equipment costs for each quantity type can be applied during the variance analysis calculations to ensure accuracy of the results; and

- The sum of all of the quantities for each of the damages analysis categories does not exceed the total quantities installed by the contractor for each discipline of work.

A cost variance analysis must often be supplemented by a man-hour5 variance analysis to ensure that:

- Man-hours associated with quantity growth are not included in the contractor’s other claims, such as claims for productivity loss;

- Man-hours included in pending and approved change orders are separately addressed and not included in the contractor’s other claims, such as its change order and productivity loss claims;

- Man-hour growth that resulted from the contractor’s bid error are not improperly included in the contractor’s other claims;

- Man-hours resulting from contractor-caused problems are not included in the contractor’s other claims; and

- The sum of all of the man-hours for each of the damages analysis categories does not exceed the total man-hours incurred by the contractor for each discipline of work.

A cumulative impact claim is often an attempt by the contractor to recover man-hours associated with multiple changes that occurred on the project. It is the “ripple” from an activity disrupted by several changes does not only impact nearby or follow-on work, but also can potentially impact any and all project work being performed concurrently or subsequent to that activity. In fact, one could argue that the impact to nearby or follow-on work is akin to “local” disruption, which the contractor should recognize and price in the change order. It is the effect, the unforeseeable impact, on other base scope work that seems to be at issue with cumulative impact claims.

A common problem is that the contractor uses a cumulative impact claim as a global claim in an attempt to recover all of its additional man-hours that it incurred above its bid man-hours as part of its overall damages request. Thus, all increased man-hours are the result of loss of productivity allegedly caused by the cumulative impact of changes.

Arbitration panels, courts, and boards seem to at least consider the effects of RFIs and other impacts, and not dismiss them for not being approved change orders. It may be reasonable that cumulative impacts derive from multiple change orders, RFIs, differing site conditions, suspensions of work, or other work interruptions that are widely recognized as compensable events. Therefore, not only can owner-approved changes be used as part of a cumulative impact claim, but also unapproved change orders and all other potentially disruptive events factor into the cause-effect relationship. However, the contractor should still recognize any direct disruption that is caused by these events during the project and submit the required change order documentation and costs.

The use of a man-hour variance analysis can help ensure that a cumulative impact claim is not being used to capture increased man-hours that may have resulted from other causes. While the quantification of increased man-hours can be performed using various methods, such as a measured mile analysis or from using various industry studies, the man-hour variance analysis will frame the man-hours such that over-recovery is precluded because the sum of the parts cannot exceed all of the man-hours incurred. If the man-hour variance is performed for all engineering and construction disciplines, significant credibility is built into the contractor’s claim. If the contractor fails to use a man-hour variance analysis in its claim calculations, and the owner can demonstrate that the contractor is claiming more man-hours than it incurred when all other damage analysis categories are considered. The contractor’s credibility suffers and its claim may be denied.

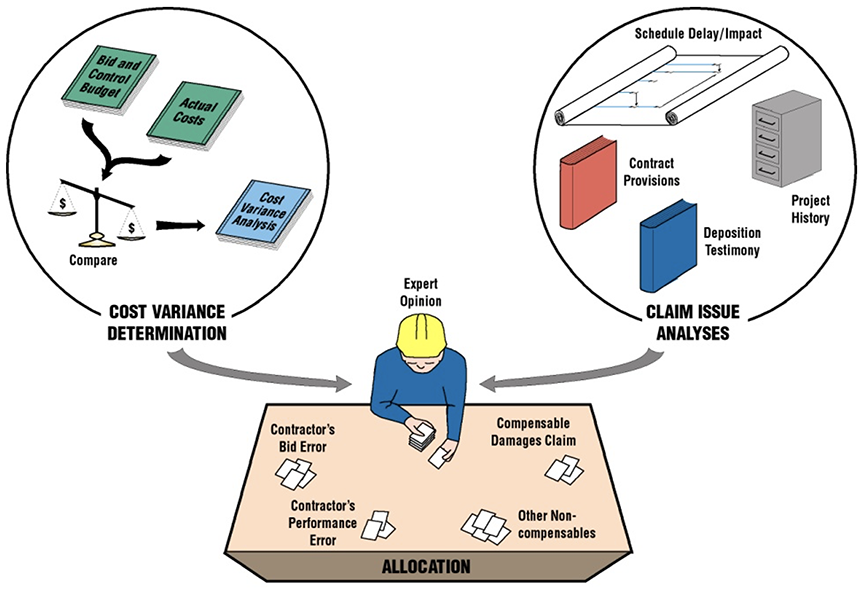

3.4 ALLOCATION OF COST VARIANCES

The final step in calculating damages under the discrete damages/cost variance analysis method is to allocate the variances to the responsible party. Categories for allocation usually include contractor bid error, contractor performance error, other noncompensable costs, and contractor compensable claim costs, as shown by Figure 6. Identification and utilization of other categories is commonly performed.

Figure 6

Discrete Damages/Cost Variance Analysis Methodology

Allocation is made by expert opinion utilizing the cost variance analyses and other parallel analyses that may include the following:

- Analysis of bid requirements;

- Analysis of contract requirements;

- Analysis of construction requirements;

- Schedule/delay/impact analysis; and

- Analysis of project history.

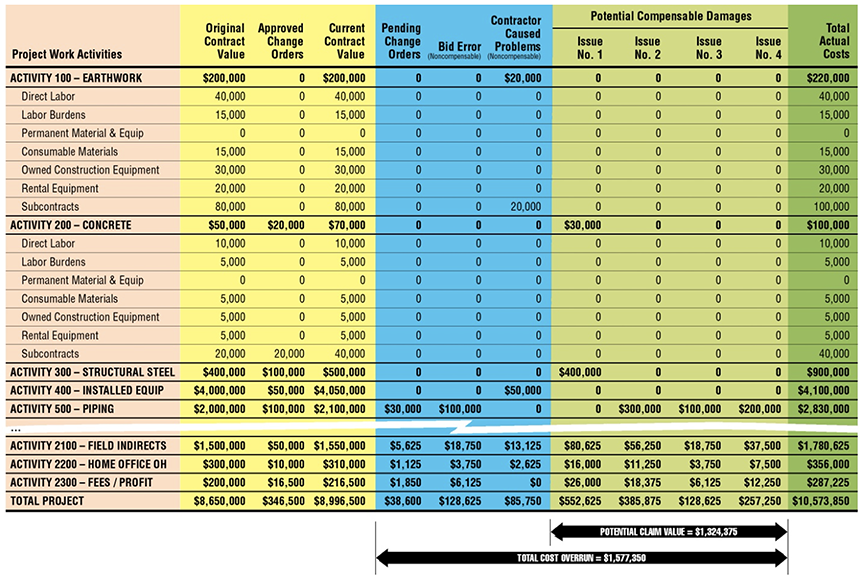

The mathematical structure of the allocation should demonstrate clearly that all variances have been included and totaled to an amount equal to the difference between the contract price and actual costs incurred. An example of the overall allocation of cost variances into a cost damages matrix using the discrete damages/cost variance analysis method is shown by Figure 7.

Figure 7

Cost / Damages Matrix

About the Author

Richard J. Long, P.E., P.Eng., is Founder of Long International, Inc. Mr. Long has over 50 years of U.S. and international engineering, construction, and management consulting experience involving construction contract disputes analysis and resolution, arbitration and litigation support and expert testimony, project management, engineering and construction management, cost and schedule control, and process engineering. As an internationally recognized expert in the analysis and resolution of complex construction disputes for over 35 years, Mr. Long has served as the lead expert on over 300 projects having claims ranging in size from US$100,000 to over US$2 billion. He has presented and published numerous articles on the subjects of claims analysis, entitlement issues, CPM schedule and damages analyses, and claims prevention. Mr. Long earned a B.S. in Chemical Engineering from the University of Pittsburgh in 1970 and an M.S. in Chemical and Petroleum Refining Engineering from the Colorado School of Mines in 1974. Mr. Long is based in Littleton, Colorado and can be contacted at rlong@long-intl.com and (303) 972-2443.

1 Often, the cost accounts used by the contractor during its bid preparation may be different than those that it used during the execution of the project in its job cost report. Hopefully, the contractor has reconciled the different cost accounts between the bid phase and the execution phase when it set up its job cost report. If not, the analyst will need to perform this reconciliation to prepare the cost/damages matrix.

2 In practice, the spreadsheet of costs will be set up in two dimensions, with the cost accounts as sub cost elements under each work activity.

3 The concept of a properly constructed control budget database is also applicable to the other damages calculation methods.

4 Quantity variance analysis includes but are not limited to engineering deliverables such as the number of design drawings, piping isometrics, and other documentation required by engineering to support the construction work, as well as physical quantities of materials to be installed during construction, such as concrete, soil quantities for import or export during site preparation, number and/or length of piles for foundations, structural steel, installed equipment, piping, instruments, electrical materials, etc.

5 Man-hour variance analysis includes but are not limited to engineering man-hours, project management man‑hours, construction direct labor man-hours by discipline, and perhaps field construction support man‑hours.

Copyright © Long International, Inc.

ADDITIONAL RESOURCES

Articles

Articles by our engineering and construction claims experts cover topics ranging from acceleration to why claims occur.

MORE

Blog

Discover industry insights on construction disputes and claims, project management, risk analysis, and more.

MORE

Publications

We are committed to sharing industry knowledge through publication of our books and presentations.

MORE