Apportionment of Indirect Costs to Significant Change Events

This article discusses the methods and considerations for apportioning indirect construction costs in a dispute setting when detailed actual indirect costs or indirect labor hour data assigned specifically to the underlying change that is being analyzed does not exist in the contemporaneous project records.

1. INTRODUCTION

The total costs associated with a construction claim, whether in the case of a claim for damages between the contracting parties or in the case of a claim with a third-party insurer, typically include both a contractor’s1 direct and indirect cost components as well as other costs. In general, indirect cost increases are captured in prolongation or thickening claims and, therefore, the indirect costs associated with a significant change event or scope of work increase may not be clearly delineated in the contemporaneous project documentation.

In some circumstances, the significant magnitude of the change, or other project-specific considerations, necessitate the apportionment of indirect construction costs to a specific, significant change event.This may be the case, for example, when the contracting parties wish to know the total cost related to a specific large issue or event, or when a contractor performs a significant amount of rework that will be submitted to an insurer as part of a claim.

During the quantum analysis of the costs for these specific types of cases, it may be necessary to apportion indirect costs to the change event to accurately capture all costs related to the change. Because a contractor typically accounts for some small amount of change in its planned costs, the budget for indirect costs can to some extent absorb the cost of relatively small changes. Thus, it should be demonstrated that any apportioned indirect construction costs are over and above the planned costs.

This article discusses the methods, concerns, and considerations for apportioning indirect costs in a dispute setting where the cost apportionment is necessary and when detailed actual indirect costs or indirect labor hour data assigned specifically to the underlying change that is being analyzed does not exist in the contemporaneous project records. Section 2 below provides an overview of the various cost components that may be relevant to a significant event, Section 3 contains detailed discussions on the recommended indirect construction cost apportionment methods and associated concerns and considerations, and Section 4 contains analysis examples that demonstrate the recommended apportionment methodology.

2. SIGNIFICANT CHANGE EVENT COST COMPONENTS

In construction projects, a contractor’s direct costs are costs that are directly attributable to the final product and typically include trade labor, materials, and installed equipment. Regardless of contract type (fixed-price, lump-sum turnkey, remeasurable, reimbursable, etc.), contractors typically capture actual direct costs and labor hours using project codes related to specific scopes of work in the contemporaneous project documentation, such as time sheets, purchase orders, progress reports, accounting ledgers, project cost reports, and invoices. It therefore may be a straightforward task to determine the actual direct costs and/or spent labor hours associated with a significant change event during the quantum cost analysis.

By contrast, a contractor’s indirect costs are often project-wide expenses that do not relate directly to the final product or to any incremental scope of work. These indirect cost items are typically referred to as preliminaries in Europe and Australia and may be referred to as either general conditions or project overhead costs in the Americas. Examples of indirect cost items include the following:

- On-site management staff including project managers, engineers, and construction supervisors;

- On-site support staff including project controls, procurement, material handling and storage, health and safety, quality assurance, human resources, security, administrative, and clerical personnel;

- Related home office costs, if applicable;

- General expenses including insurances, training, personal protective equipment (PPE), regulatory compliance, and permitting;

- Indirect equipment including transportation, communication, and material handling equipment; and

- Temporary facilities including site offices/trailers and associated utilities.

It is unlikely that a contractor’s indirect costs such as general expenses, equipment, and temporary facilities, which are shared amongst multiple scopes of work, will be assigned to specific scopes of work in the contemporaneous project documentation. Depending on the contract type, the actual labor hours and associated costs for the indirect personnel may or may not be well documented and assigned to specific scopes of work in the contemporaneous project documentation. Therefore, in cases that necessitate the determination of the total cost of a specific change or event, it is likely that the expert or claim analyst2 will need to apportion indirect costs to the specific change during the quantum cost analysis.

In addition to the typical direct and indirect construction costs discussed above, there may be other support costs associated with the change event that may also need to be apportioned during the quantum cost analysis. These additional support costs may include costs associated with accommodations (worker housing/camps), transportation to and from the project site, and oversight by the engineering, procurement, and construction (EPC) company personnel.

3. INDIRECT COST APPORTIONMENT METHODOLOGY

Subject to the concerns and considerations discussed below in Sections 3.1 through 3.6, this author recommends apportioning a contractor’s actual indirect costs and/or labor hours for a significant change event using pro rata factors based on actual (spent) direct labor hours associated with the change. Direct labor hours are the best indication of relative work effort during a period of time, and it is therefore appropriate to use them as the basis to apportion indirect costs in proportion to the work effort. In other words, with consideration for the timing of the change event as discussed below in Section 3.2, a portion of the total indirect costs can be assigned to the specific change by multiplying the total indirect costs by the ratio of the spent direct labor hours related to the change to the total spent direct labor hours. This is shown below in Equation 1, where IC is indirect costs, DLH is spent direct labor hours, and the ratio of change-related direct labor hours to total direct labor hours is the pro rata factor:

Equation 1

If sufficient, reliable spent direct labor hour data is not available, the use of pro rata factors based on actual direct labor costs associated with the change is an acceptable alternative. If sufficient, reliable spent direct labor hour or actual direct labor cost data is not available, pro rata factors based on actual direct headcount associated with the change can be used. When using actual direct labor cost or headcount data instead of labor hour data, the appropriate data is simply substituted for the spent direct labor hours in Equation 1 above.

Pro rata factors based on direct labor costs are often similar to those based on spent direct labor hours, especially for reimbursable or T&M contracts when the distribution of labor categories associated with the change of interest is similar to the overall distribution of labor categories across the project. Generally, direct costs related to equipment and especially materials should be excluded from calculation of the pro rata factors when possible because costs associated with direct labor are a better indication of relative work effort than those associated with materials.

As applicable, the indirect construction cost apportionment should be performed at the subcontract level. For example, for a change associated with both piping and insulation work, the piping subcontractor’s indirect costs should be apportioned based on the piping subcontractor’s spent direct labor hours and the insulation subcontractor’s indirect costs should be apportioned based on the insulation subcontractor’s spent direct labor hours.

In situations where it is necessary or desirable to also apportion spent indirect labor hours that are associated with a change, a similar approach can be used, as shown below in Equation 2, where ILH is spent indirect labor hours and DLH is spent direct labor hours:

Equation 2

As mentioned above, the above methodology and equations are subject to the concerns and considerations set out below in Sections 3.1 through 3.6.

3.1 CONSIDERATION OF EXISTING PROJECT DATA FOR INDIRECT COSTS

The above cost apportionment methodology should be used in situations where the contractor’s indirect costs associated with a significant change event or scope of work increase are not clearly delineated in the contemporaneous project documentation. In situations where this indirect cost data exists, i.e., in situations where the indirect costs have been clearly and reliably assigned to the change at hand in the contemporaneous project documentation, that data should be used directly, and therefore no apportionment calculation would be necessary. In cases where only a portion of the indirect costs, such as costs for an on-site supervisor, have been assigned to the change, but the balance of nominal indirect costs has not, some additional indirect cost apportioning may be appropriate, as further discussed below in Section 3.4.

Additionally, in situations where the indirect construction costs have not been assigned to a specific change in the project documentation, but the indirect labor hour or headcount data has been assigned to a specific change in the project documentation, that labor hour (preferably) or headcount data can be used to apportion the indirect labor costs. At the analysts’ judgement and experience, based on the situation at hand and the reliability of the available indirect labor hour or headcount data, the remaining indirect costs (i.e., general expenses, indirect equipment, and temporary facilities) can be apportioned using either the indirect or the direct labor hour data using Equation 1 above.

The extent and reliability of the indirect cost and/or labor hour data available relative to a specific change may depend somewhat on the contract or subcontract type. In fixed-price or reimbursable contracts, it is unlikely that indirect costs will be assigned to specific scopes of work. In the case of reimbursable or T&M contracts where spent indirect labor hours and actual costs are recorded and reported in detail, these costs may or may not be assigned to specific scopes of work in the contemporaneous project documentation.

3.2 CONSIDERATION OF TIMING

The timing of the change being analyzed relative to the duration of the project as a whole should also be considered during the indirect cost apportionment. That is, at the judgment and experience of the analyst and assuming the data is available and reliable, only the indirect construction costs and direct labor hours spent during the duration of the change should be considered in the apportionment calculation. Indirect costs accrued before or after the changed work are usually not relevant. Therefore, the total indirect costs, total spent indirect labor hours, and total spent direct labor hours indicated in Equation 1 and Equation 2 above should only include the labor hours and costs that were accrued during the duration of the work associated with the change at hand.

Additionally, the analyst should determine whether the use of a single pro rata factor based on the totality of the data during the duration of the change or the use of weekly or monthly pro rata factors is more appropriate based on the nature of the available data. In situations where there are large differences in the direct or indirect data over time that are likely attributable to the change, the accuracy of the apportionment calculation may be improved by performing the apportionment on a weekly or monthly basis, where the costs and labor hours indicated in Equation 1 and Equation 2 above are summarized on a weekly or monthly basis instead of on the basis of the total duration of the change at hand. However, more detailed apportionment calculations come at the expense of additional analysis effort and cost, as discussed further in Section 3.5 below.

3.3 CONSIDERATION OF OTHER COSTS

In some situations, there may be other support costs associated with the change event that may also need to be apportioned during the quantum cost analysis. These additional support costs may include costs associated with accommodations (both direct and indirect worker housing/camps), transportation to and from the project site, and oversight by the engineering, procurement, and construction (EPC) company personnel.

In large projects with multiple subcontracts, these support costs may be associated with the main EPC contract or with subcontractors other than the particular subcontractor(s) that are performing the additional work. Therefore, in some cases, it will be important that the analyst consider the project as a whole when performing the quantum cost analysis for a particular change event, rather than focusing solely on costs related to the subcontract(s) that initially gave rise to the claim.

For example, housing for project workers may be the responsibility of a dedicated accommodations subcontractor rather than the responsibility of the subcontractor performing the direct work. The accommodations costs would likely increase as a result of the change-related work and should therefore be apportioned to the change event. The increased costs could be quantified either as a daily rate or apportioned otherwise, with the apportionment methodology depending in large part on the availability, reliability, and basis of the data found in the contemporaneous project documents. Where possible, these costs should also be apportioned using spent labor hour data as per Equation 1 above.

3.4 CONSIDERATION OF AVOIDING THE DOUBLE COUNTING OF COSTS

It is important to ensure that costs and/or labor hours are not double counted when performing the apportionment calculations. Prior to apportioning indirect costs to a specific change, the analyst should verify that the reported labor hours and costs associated with the change do not already include indirect costs and labor hours. If all associated indirect labor hours and costs are self-contained in the reported change cost, it is not necessary to further apportion additional costs or labor hours from the nominal pool of indirect cost items. Furthermore, once the indirect costs have been apportioned to the change event at hand, it is important to verify that they have been removed from all other claims such as prolongation and thickening claims to avoid double counting.

In some cases, the reported costs associated with the change at hand may contain some related indirect costs, such as the addition of a shift supervisor, but may not contain any additional costs from the nominal pool of indirect cost items such as those related to upper management, project support roles, and general overhead expenses such as construction equipment and temporary facilities. In these situations, it will likely still be appropriate to apportion the general indirect costs to the change at hand.

3.5 CONSIDERATION OF ANALYSIS ACCURACY VS. ANALYSIS EFFORT AND COST

As mentioned above in Section 3.2, improving the accuracy of the quantum cost calculations, including the accuracy of the indirect cost apportionment, comes at the expense of additional analysis effort and associated costs. Therefore, the methodology employed should consider the purpose of the analysis and the level of accuracy required as well as the additional costs required to improve the accuracy of the analysis. For example, if the analyst estimated that employing a more detailed methodology would likely improve the final cost estimate by only a few percent, but it results in a significant increase in analysis effort and cost, an in-depth, detailed analysis may not be warranted.

This is especially true when considering whether to employ overall vs. weekly or monthly pro rata factors for the indirect cost apportionment, where the analysis effort can become overly cumbersome for larger projects. This concern can also apply when determining whether to use labor hour or cost data for the indirect cost apportionment, based on the availability and reliability of the various data sets in the contemporaneous project records.

3.6 CONSIDERATION OF EXPERT JUDGEMENT AND EXPERIENCE

The final methodology employed for the indirect cost apportionment should include consideration of the analyst’s expert judgement and experience in performing these types of analyses. In some cases, the analyst may assess that direct cost data is more readily available and/or more reliable than direct labor hour data, in which case it may be acceptable to apportion the indirect costs on a cost basis rather than a labor hour basis. Likewise, the analyst may assess that the available data is too limited, or that the data has already been overly segmented, such that it may be acceptable to perform the apportionment calculations on an overall basis instead of a weekly or monthly basis. As discussed above in Section 3.5, the cost and effort associated with the analysis should also be considered in the final selection of the apportionment methodology.

Finally, the analyst should also consider the appropriate level of granularity to apply with respect to cost breakouts and the work breakdown structure when comparing cost increases apportioned to the change event to the planned costs. Generally, the appropriate granularity will depend in large part on the composition and reliability of the available indirect cost data.

4. INDIRECT CONSTRUCTION COST APPORTIONMENT EXAMPLES

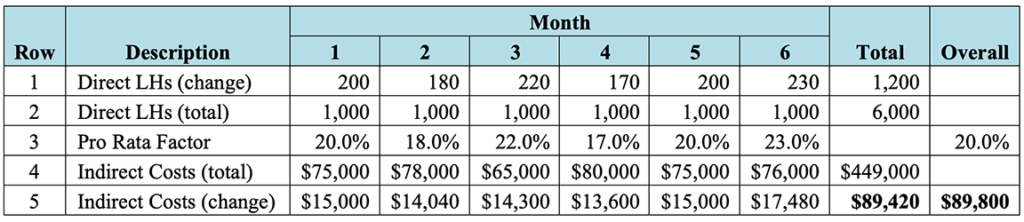

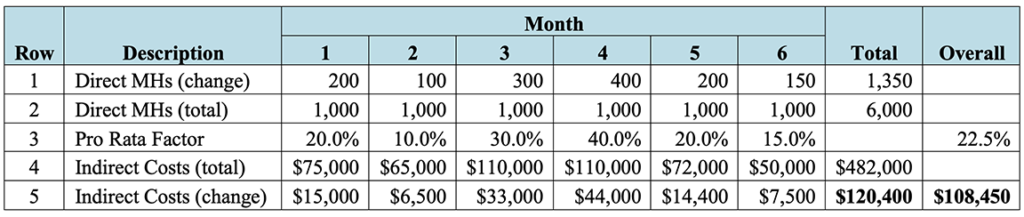

The following two examples illustrate the use of Equation 1 above for indirect cost apportionment using pro rata factors based on spent direct labor hours. Both examples consider a hypothetical scenario where the contractor’s planned peak monthly indirect costs were $60,000 and where there was a significant increase in the scope of work that lasted for a duration of six months that resulted in higher monthly indirect costs. For these examples, it is assumed that: (i) the contractor’s spent direct labor hours related to the scope increase, total spent direct labor hours, and total indirect cost data were available by month, and (ii) the contractor’s associated spent indirect costs and labor hours were not assigned to the change in the project documentation.

The results of the examples are shown in Table 4‑1 and Table 4‑2 below. Both tables contain the following data and calculations:

- Row 1: spent direct labor hours related to the change;

- Row 2: total spent direct labor hours;

- Row 3: calculated pro rata factors (Row 1 divided by Row 2)

- Row 4: total indirect costs; and

- Row 5: indirect costs apportioned to the change (Row 3 multiplied by Row 4).

In the first example, shown in Table 4‑1 below, the spent direct labor hours and the indirect costs were reasonably uniform and did not vary significantly month to month. As can be seen in Table 4‑1, the apportioned indirect costs calculated using an overall pro rata factor were $89,800, while those calculated using monthly pro rata factors were $89,420, for a difference of only $380, or 0.4%. In this scenario, where there is only minimal, mostly random variation in the data over time, the additional effort associated with summarizing the data and performing the apportionment calculations by month results in less than a 1% difference in the analysis results. In this case, the additional analysis cost and effort may not be justified.

Table 4‑1: Example #1: Minimal Difference in Month-to-Month Costs and Labor Hours

In the second example, shown in Table 4‑2 below, the spent direct labor hours related to the change and the indirect costs varied significantly month to month. As can be seen in Table 4‑2, the apportioned indirect costs calculated using an overall pro rata factor were $108,450, while those calculated using monthly pro rata factors were $120,400, for a difference of $11,950, or 11.0%. In this scenario, where there are significant differences in the data over time, the additional effort associated with summarizing the data and performing the apportionment calculations by month results in over a 10% difference in the analysis results. In this case, the additional analysis cost and effort may be justified.

Table 4‑2: Example #2: Significant Difference in Month-to-Month Costs and Labor Hours

5. SUMMARY

In summary, this author recommends the use of pro rata factors based on the contractor’s spent direct labor hours for indirect cost apportionment in situations where it is necessary to determine the total costs associated with a significant change event or scope of work increase, and where clear assignment of the indirect costs to the change at hand does not exist in the contemporaneous project documentation. When sufficient, reliable spent direct labor hour data is not available, direct labor costs or direct labor headcount data can be used instead.

Additionally, the timing of the change and variations in direct labor hours and indirect costs over time, the potential for the existence of additional support costs such as accommodation and transportation costs, and the avoidance of double counting direct and indirect costs and labor hours should all be considered when finalizing the apportionment methodology. Finally, analysts should use their judgement and experience when selecting an apportionment methodology based on the type and assessed reliability of the available data, and the trade-off of increased results accuracy vs. increased analysis effort and cost should be considered.

About the Author

Eric J. Klein, Ph.D., P.E., PMP, is a Vice President of Long International. He has over 20 years of industrial experience as a Technical Leader, Project Manager, and Consultant in engineering, procurement, and construction (EPC), manufacturing, and research and development (R&D) environments. Dr. Klein is skilled in corporate leadership and has significant experience leading cross-functional teams to design, build, commission, start up, and test chemical processing systems in the power generation and semiconductor manufacturing industries. He possesses project management experience for multimillion‑dollar capital projects including earned value management, risk management, contract and scope of work negotiation, technical project proposals, cost estimating, change control, requests for information (RFI), change order management, design management, and equipment procurement oversight. He has experience reviewing drawing packages and performing quantum cost analysis for LNG projects. Prior to joining Long International, Dr. Klein held the positions of Chief Technology Officer, Vice President of Chemical Systems, Director of Chemical and Process Engineering, Staff Technologist, and Senior Process Engineer. Dr. Klein is based in the Denver, Colorado area and can be contacted at eklein@long-intl.com and (720) 982-3813..

1 The term “contractor” is used herein to generally refer to the party that is bringing the claim for labor hours and costs.

2 The term “analyst” is used hereafter to refer to the expert or claim analyst.

Copyright © Long International, Inc.

ADDITIONAL RESOURCES

Articles

Articles by our engineering and construction claims experts cover topics ranging from acceleration to why claims occur.

MORE

Blog

Discover industry insights on construction disputes and claims, project management, risk analysis, and more.

MORE

Publications

We are committed to sharing industry knowledge through publication of our books and presentations.

MORE