October 3, 2022

Carbon Capture – A Capital-Intensive Technology with Large Growth Potential

This is the first post in a six-part series that discusses carbon capture information, utilization, and sequestration. The series will cover topics including industry background; market overview and drivers; past, current, and planned carbon capture projects; and overviews of typical carbon capture technologies.

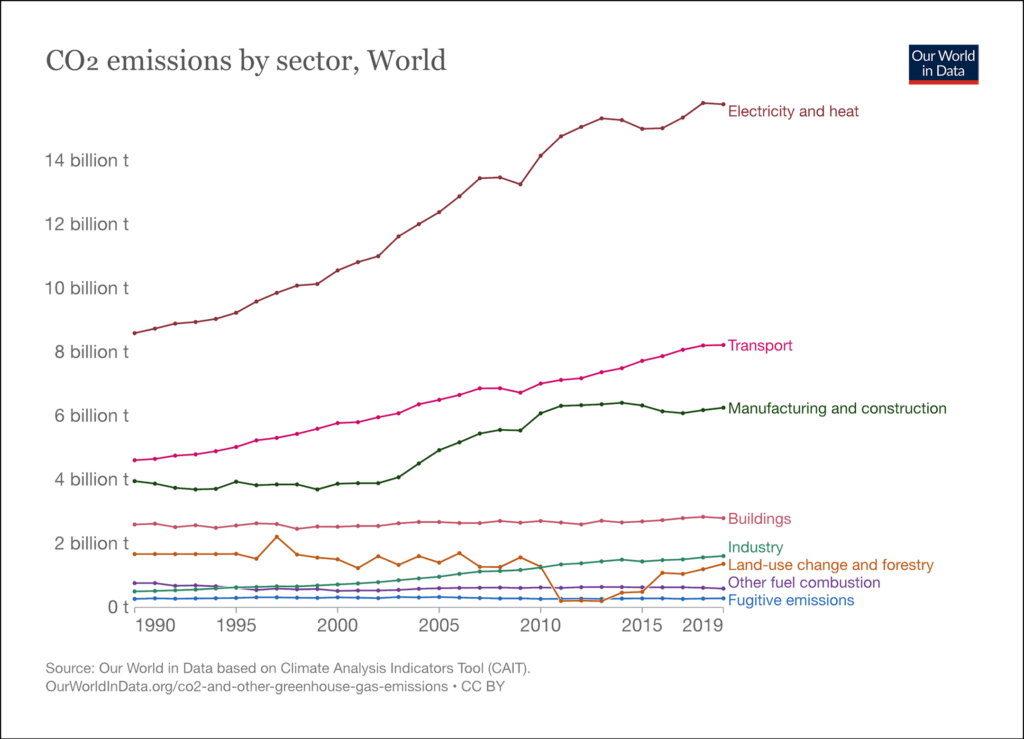

Carbon dioxide (CO2) is a greenhouse gas that is formed and/or released during the combustion of fossil fuels (most notably in the power generation and transportation sectors), during the extraction and processing of natural gas, and by various important industrial processes including but not limited to the production of cement and ammonia. The scale of global CO2 emissions is large and growing. As shown in Figure 1 below, it is reported that global CO2 emissions in 2019 totaled approximately 36.9 Gigatonnes (Gt), i.e., 3.69 × 1013 kg, with nearly two-thirds of the CO2 emissions originating in the power and heat generation and transportation sectors.1 Because CO2 is a greenhouse gas, the reduction of future CO2 emissions and atmospheric CO2 concentrations is a focus of initiatives aimed at minimizing global temperature increase to below 2°C, preferably to below 1.5°C, above pre-industrial temperatures as agreed upon by 196 parties in the 2015 Paris Agreement2 and reconfirmed in the 2021 Glasgow Agreement.3

Figure 1: Global CO2 Emissions Trends by Sector

Carbon capture, utilization, and sequestration (CCUS) is a technology with the potential to aid in the attainment of this goal. In CCUS, CO2 is captured—from post-combustion flue gases, during various industrial production processes including the processing of natural gas, or directly from the atmosphere itself—and is then either: (i) used as a feed stock in chemical processing operations (utilization); or (ii) compressed to its supercritical state for transport via pipelines to destinations where it is subsequently injected into oil reservoirs in enhanced oil recovery (EOR) operations and/or permanently stored in underground reservoirs (sequestration).

The Intergovernmental Panel on Climate Change (IPCC) has suggested pathways, which include the deployment of CCUS technology, for attaining the goal of the Paris Agreement based on its modeling of various possible scenarios for global CO2 emissions trends and corresponding temperatures over the next several decades.4 Because most scenarios include the usage of fossil fuels for the next several decades, CCUS may be a necessary technology for meeting CO2 emissions goals.5 For example, with regards to the U.S. power generation sector, the U.S. Energy Information Administration (EIA) reports that fossil fuels will continue to be a significant fuel source through at least 20506 and the U.S. Environmental Protection Agency (EPA) lists post-combustion CCUS as an opportunity for the mitigation of CO2 emissions.7

In “What Are Carbon Credits? How Fighting Climate Change Became a Billion-Dollar Industry,” 30 October 2021,8 Lucas Thompson and Leticia Miranda at NBC News summarized the workings of the current CCUS market. They describe that the market is largely driven by the sales and/or trading of carbon credits via both a voluntary market, where a carbon credit represents one metric tonne of CO2 removed from the atmosphere, and a compliance (or cap-and-trade) market, where governments set limits on CO2 emissions from various sectors.

Mr. Thompson and Ms. Miranda report that while the U.S. does not have a federal cap-and-trade market for CO2 emissions, the State of California has established its own cap-and-trade market and the State of Washington recently passed a law that caps CO2 emissions for certain sectors. Globally, they report that there are 64 carbon compliance markets in operation with the largest markets being in the European Union, China, Australia, and Canada. Additionally, the World Bank reports that these 64 carbon markets cover over 20% of global greenhouse gas emissions and generated $53 billion in revenue in 2020–21.9 Interestingly, it was recently reported that Occidental Petroleum has reached an agreement with Airbus to sell 400,000 carbon credits associated with its planned direct air capture (DAC) facility in the U.S.’ Permian Basin.10

Additionally, Section 45Q of the U.S. tax code offers tax credits for CCUS. In “US Tax Credit Encourages Investment in Carbon Capture and Storage,” 29 January 2021,11 Michael Rodgers and Brandon Dubov of the law firm White & Case summarized the provisions and history of the Section 45Q tax credit, which was recently expanded in 2018 and again in 2020, and which they indicate is likely to contribute to growth in the market. In addition to the provisions for tax credits in the U.S., it was also recently reported that the U.S. Department of Energy (DOE) is planning to use $3.5 billion, which was allocated for DAC in the 2021 infrastructure law, to fund four DAC facilities spread out across the U.S.12

While still in its early stages, the CCUS market has the potential to grow significantly over the coming decades, with the International Energy Agency (IEA) pushing for an increase from today’s annual CO2 storage of 40 million metric tonnes to 5.6 billion tonnes by 2050, a 140-fold increase, which equates to approximately 70–100 new CCUS projects per year.13 ClearBridge Investments writes that CCUS can develop into a major industry worth up to $1 trillion per year, and indicates that oil companies, which are leading investments globally, are well-positioned to lead in this emerging market given the presence of existing infrastructure such as existing CO2 pipeline networks that support EOR in the U.S. Gulf Coast.14 While the 2021 global CCUS market has been estimated at $2 billion, Occidental Petroleum estimates that the market will reach $50 billion by 203015 and Exxon Mobil predicts the market may be worth $4 trillion by 2050.16 In addition to the market drivers discussed above such as CO2 cap-and-trade credits and U.S. tax credits, CO2 capture and subsequent beneficial reuse as a feedstock in chemical processing plants or for EOR may have the potential to be profitable in its own right, depending on the cost of CO2 capture technology and process, CO2 price, and oil prices.

Importantly, with respect to the global construction industry, the deployment of CCUS technologies typically results in large capital projects. Installation of post-combustion CCUS systems, which capture CO2 from flue gas downstream of combustion processes, typically entails retrofitting existing CO2 point sources (such as fossil fuel-fired power generation stations) with large CO2 absorber and stripper vessels; associated ducting, fans, piping, and pumps; and supercritical CO2 compressors. DAC systems, which capture CO2 directly from the atmosphere, typically entail the greenfield installation of CO2 capture, regeneration, compression, and associated ancillary equipment. Occidental Petroleum has recently announced that it is planning to spend up to $1 billion to install the world’s largest DAC system, capable of capturing up to one million tonnes of CO2 per year, in the Permian Basin.17, 18 In addition to the aforementioned carbon capture equipment, broad commercial adoption of carbon capture would likely require the construction of tens of thousands of miles of CO2 pipelines in the U.S. alone.19

As detailed above, CCUS is a capital-intensive industry with the potential for large growth. Subsequent blog posts on this topic will discuss current and planned global CCUS projects and provide overviews of typical carbon capture technologies.

1 Hannah Ritchie and Max Roser, “Emissions by sector.” Our World in Data. Accessed September 20, 2022. https://ourworldindata.org/emissions-by-sector.

2 “The Paris Agreement.” United Nations Framework Convention on Climate Change. Accessed September 20, 2022. https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement.

3 “COP26: Together for Our Planet.” United Nations. Accessed September 20, 2022. https://www.un.org/en/climatechange/cop26.

4 “Global Warming of 1.5 ºC.” The Intergovernmental Panel on Climate Change. Accessed 20 September 2022. https://www.ipcc.ch/sr15/.

5 Dimitry Dayen, “Carbon Capture: Early Days of a $1 Trillion Industry?” ClearBridge Investments, February 22, 2022. Accessed September 20, 2022. https://www.clearbridge.com/perspectives/institutional/2022/carbon-capture-early-days-of-a-usd1-trillion-industry.

6 “Annual Energy Outlook 2022.” U.S. Energy Information Administration, March 3, 2022. Accessed September 20, 2022. https://www.eia.gov/outlooks/aeo/narrative/electricity/sub-topic-02.php.

7 “Sources of Greenhouse Gas Emissions.” United States Environmental Protection Agency. Accessed September 20, 2022. https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions.

8 Lucas Thompson and Leticia Miranda, “What are carbon credits? How fighting climate change became a billion-dollar industry.” NBC News, October 30, 2021. Accessed September 20, 2022. https://www.nbcnews.com/business/business-news/are-carbon-credits-fighting-climate-change-became-billion-dollar-indus-rcna3228.

9 “Carbon Prices now Apply to Over a Fifth of Global Greenhouse Gases.” The World Bank, May 25, 2021. Accessed September 20, 2022. https://www.worldbank.org/en/news/press-release/2021/05/25/carbon-prices-now-apply-to-over-a-fifth-of-global-greenhouse-gases.

10 Sabrina Valle, “Occidental signs four-year deal with jet-maker Airbus for carbon credits.” Reuters, March 17, 2022. Accessed September 20, 2022. https://www.reuters.com/business/sustainable-business/occidental-signs-four-year-deal-with-jet-maker-airbus-carbon-credits-2022-03-17/.

11 Michael Rodgers and Brandon Dubov, “US tax credit encourages investment in carbon capture and storage.” White and Case, January 29, 2021. Accessed September 20, 2022. https://www.whitecase.com/insight-our-thinking/us-tax-credit-encourages-investment-carbon-capture-and-storage.

12 John Timmer, “Biden administration lays out plan for four carbon-capture facilities.” Ars Technica, May 21, 2022. Accessed September 20, 2022. https://arstechnica.com/science/2022/05/biden-administration-lays-out-plan-for-four-carbon-capture-facilities/.

13 Roy Eccleston, “The great carbon capture and storage debate: can Santos make it work?” Cosmos Weekly, November 2, 2021. Accessed September 20, 2022. https://cosmosmagazine.com/technology/energy/santos-carbon-capture-storage-feasible-ccus/.

14 Dayen, “Carbon Capture.”

15 Kit Norton, “Fueling Carbon Capture In the Oil Industry: Production, Net Zero And ESG.” Investor’s Business Daily, July 29, 2022. Accessed September 20, 2022. https://www.investors.com/news/carbon-capture-oil-industry-production-net-zero-esg/.

16 Sabrina Valle, “Exxon sees carbon capture market at $4 trillion by 2050.” Reuters, April 19, 2022. Accessed September 20, 2022. https://finance.yahoo.com/news/exxon-sees-carbon-capture-market-231851642.html.

17 Valle, “Occidental signs four-year deal.”

18 Norton, “Fueling Carbon Capture.”

19 Ibid.

ADDITIONAL RESOURCES

Blog

Discover industry insights on construction disputes and claims, project management, risk analysis, and more.

MORE

Articles

Articles by our engineering and construction claims experts cover topics ranging from acceleration to why claims occur.

MORE

Publications

We are committed to sharing industry knowledge through publication of our books and presentations.

MORE

Recommended Reads

Construction Claim Types for Contractors

U.S. federal and state courts recognize 19 basic construction claim entitlements for a contractor’s recovery of damages. This post is the first of a series discussing each of these 19 types.

READ

Definitions of Construction Claim Types for Contractors

The author summarizes the definitions of the 19 construction claim types that may apply to a contractor's and subcontractor's recovery of time and costs.

READ

Contract Language: Defining Standard of Care and Good Industry Practice

Language in EPC and EPCM contracts defines standards of care and excellence, good industry practice, and required skills and capacity to perform.

READ