August 28, 2025

Quantitative Schedule and Cost Risk Analysis: Part 1

Engineering and construction projects frequently overrun their planned completion dates and budgeted total costs. Very large and complex projects, often called “megaprojects,” may be especially risky and are sometimes described as “fragile” because issues in completing a key task in one area often affect other areas, which may ultimately cause significant schedule and cost overruns for the entire project. This is the first of two blog posts on quantitative schedule and cost risk analysis. This post covers the purpose of this type of analysis, its typical results, and how the results are used. The second post will address components of a well-structured quantitative schedule and cost risk analysis procedure.

Most projects are so interconnected that experienced project management personnel cannot adequately contemplate and evaluate the “knock-on” effects of risks that cascade throughout them. For a holistic view of the effect of risk on project schedule, cost, and success, risk analysts turn to automated computer software to develop quantitative risk analysis models of a project. Analysts accumulate data on project uncertainty and risk and calculate the probable effects of the complex interactions of risks and uncertainties using schedule and cost models and Monte Carlo simulation. The purpose is to gain a better understanding of the project in the environment of risk and uncertainty.

Quantitative schedule and cost risk analysis allows the risk analyst to estimate:

- How likely is the project to meet its schedule and cost goals?

- How much schedule and cost contingency is needed to achieve the project’s desired level of certainty?

- Which risks are causing the most potential overrun and are thus high priorities for risk mitigation?

An integrated schedule and cost risk analysis can improve the realism of schedule and cost forecasts and prioritize the most severe risks for mitigation. The risk analysis model typically utilizes a summary Level 3 project schedule, which is enhanced by including cost loading of schedules using summary resources or a templated Excel module that uses the cost breakdown structure to represent the cost estimate. This project model is analyzed using Monte Carlo simulation techniques to estimate the probabilistic schedule and cost results, leading to improved visibility of high-priority risks that can be mitigated for improved performance.

Quantitative risk analysis can evaluate the impact of all risks and uncertainties on a project’s time and cost objectives. Hence, quantitative risk analysis can derive results that the deterministic schedule and cost estimate and qualitative risk analysis cannot provide, namely the completion date and project cost associated with a desired level of confidence when all risks are considered within the entire project model. Because the quantitative risk analysis method identifies the root causes of risks, their probability of occurring, their impact if they occur, and the activities and costs that they affect, it enables the prioritization of risks that may be mitigated for better project schedule and cost results.

Quantitative risk analysis allows the analyst to estimate the project completion date and cost with a probability distribution that is created by applying Monte Carlo simulation to a project plan such as the schedule, cost estimate, or cost-loaded schedule that uncertainty and risks may affect. The inputs are uncertainty ranges applied to activity durations or cost estimates, although there may also be probabilistic branches related to discontinuous events and weather and other calendar effects. Dr. Lincoln E. Moses, who spearheaded the development of biostatistics at Stanford University, said, “There are no facts about the future.”1

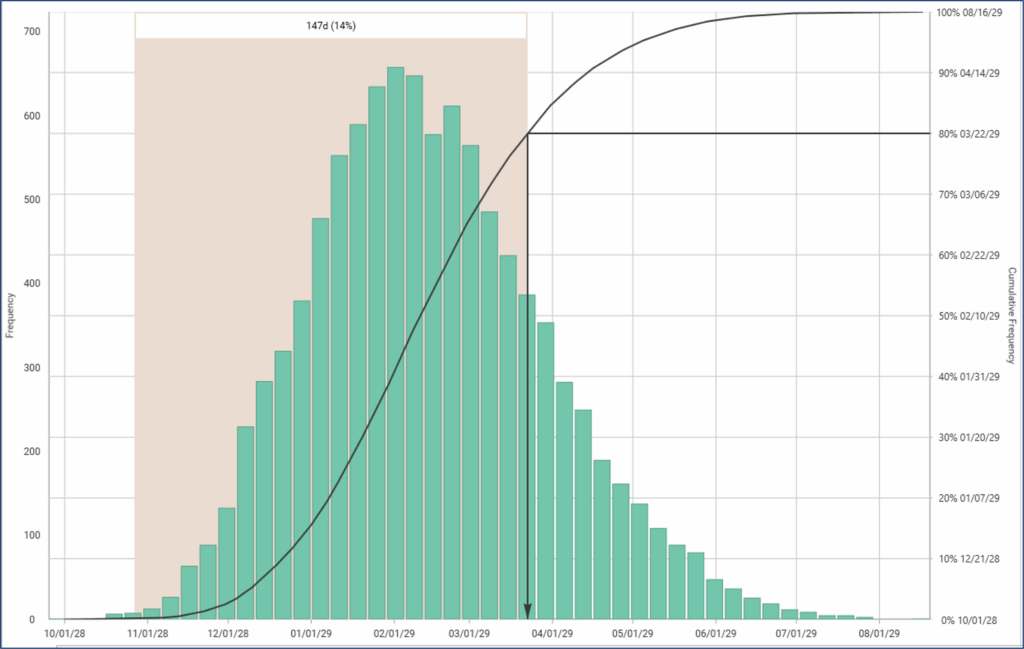

Figure 1 below is an example of a schedule risk analysis using a Monte Carlo simulation. This chart shows that, when all schedule risks are considered, there is an 80 percent probability that the project will be completed no later than March 22, 2029.

Figure 1

Typical Schedule Risk Result for a Monte Carlo Simulation

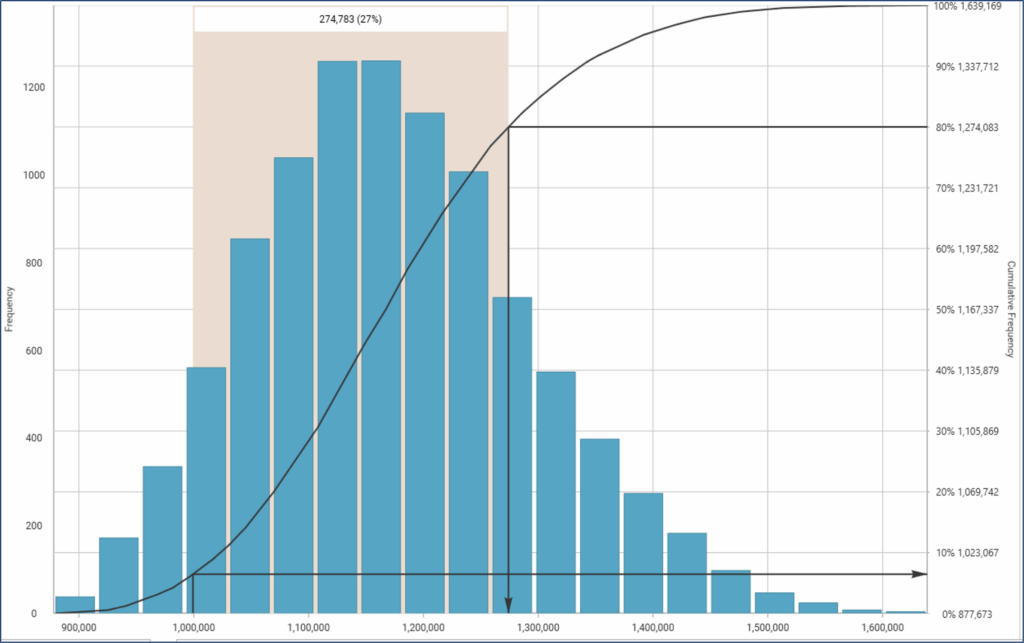

Figure 2 below is an example of a cost risk analysis using a Monte Carlo simulation. This chart shows that, when all cost risks are considered, there is an 80 percent probability that the project will cost no more than $1,272,256.

Figure 2

Typical Cost Risk Result for a Monte Carlo Simulation

1 “Administrator’s Message, Volume Three, “Projections,” Annual Report to Congress 1979, U.S. Department of Energy, Energy Information Administration.

ADDITIONAL RESOURCES

Blog

Discover industry insights on construction disputes and claims, project management, risk analysis, and more.

MORE

Articles

Articles by our engineering and construction claims experts cover topics ranging from acceleration to why claims occur.

MORE

Publications

We are committed to sharing industry knowledge through publication of our books and presentations.

MORE

RECOMMENDED READS

The Role and Benefit of a Consultant in a Construction Project: Part 1

This is the first blog post in a two-part series on the role and benefit of a construction consultant.

READ

A Tale of Two Claims: Same Contract, Two Fates

The success of a claim often hinges not on what happened in the field, but how it was documented, analyzed, and communicated.

READ

Construction Claims Prevention and Resolution

This article presents ways to prevent, resolve, and manage construction claims.

READ